“Winners Average Winners”

“Let Your Winners Run”

There are plenty of adages out there to let us “trimmers” know that it’s pointless to sell/trim your big winners. And in some cases, they are right. But some cases are not ALL cases.

Managing a portfolio of businesses goes well beyond “maximizing return”. PM and investor emotions need to be considered. Risk management needs to be considered. Humility needs to be considered.

John Huber re-posted a Xeet the other day that reminded me about one of his earlier blog posts and about the overall topic of Hold/Sell/Trim:

John’s old blog post touched on this in quite some detail: The Market Value Fluctuations of the 10 Largest Companies

I recommend going to read the post in its entirety, but here is a chart from the piece that does a good job of illustrating the concept that in the short-term (1 Year), sentiment can vary greatly in terms of price, even for the largest and most followed businesses:

Now I’m a known “trimmer”. I place industry caps on my portfolio ~12% (Will trim back to 10% usually). I place single stock caps on my portfolio at around 7% (Will trim back to 5% usually). And I do the reverse with “adds”.

For me, it’s in my own risk make-up. I am not comfortable with a name becoming that large because:

- 1. I don’t ever want to deal with a name that makes up 20% of my portfolio and that drops 20%+ on earnings (It will happen).

- 2. I have no clue what the future holds and so balancing industry/business diversification is paramount.

And, as Turtle Creek shows, it’s not always a lose of returns when you run a 20-30 stock portfolio of high-quality businesses.

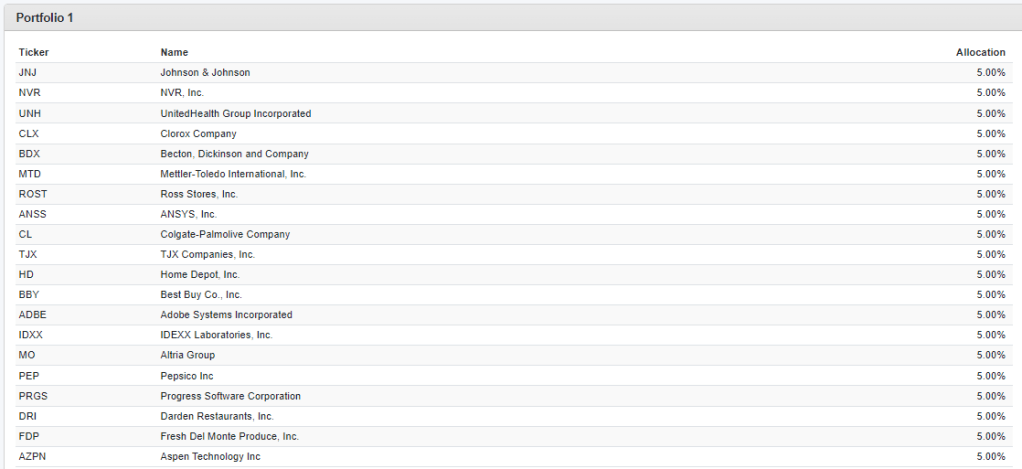

So let’s run a test. I went back and pulled up my 2004 screen results and hand-selected 20 companies from the Top 100 Quality Growth at a Reasonable Price list. Here they are:

The rule was simple. Run this portfolio with an annual re-balance (Trim/Add) and run it with a no rebalance (Let Winners Run) over the last 20 years (2004 – 2023). Here are the results:

- Annual Re-balance: 15.23% CAGR; 14.20% St. Dev.; 35.89% Max DD; 0.97 Sharpe; 0.42 MAR

- No Re-balance: 15.05% CAGR; 15.28% St. Dev; 39.26% Max DD; 0.91 Sharpe; 0.38 MAR

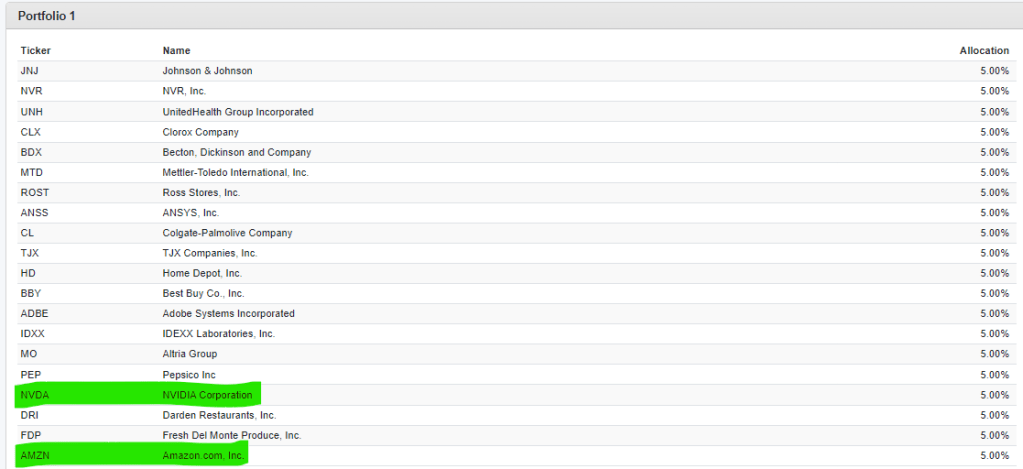

Look at that. You actually had worse results with “Let Winners Run”. Now you might say well okay, but the rule really makes sense when you have huge winners like Nvidia or Amazon. And yes, you are right, but let’s see how much it really does matter. Let’s replace two of the tech stocks in the above portfolio, PRGS and AZPN with NVDA and AMZN:

- Annual Re-balance: 17.79% CAGR; 14.77% St. Dev; 34.56% Max DD; 1.09 Sharpe; 0.51 MAR

- No-rebalance: 18.93% CAGR; 17.95% St. Dev; 41.54% Max DD; 0.98 Sharpe; 0.46 MAR

Yes, with names like NVDA and AMZN, you did earn higher returns with “Let Winners Run”, but my guess is, not by as much as you might think over a 20 year period (~1%). On top of that, you had higher day to day volatility, a larger max drawdown and lower risk/return metrics. Oh and you would have to mentally deal with one position becoming over 20%/30%/40% of your portfolio to achieve that extra 1%. Very few people can manage that emotionally (I know I can’t).

So what did we learn? Well, that adages are just that. And going against them to make sure your portfolio, and the management of said portfolio, fits your personality, usually results in a much lower trade-off than most might want you to believe.

So, if you own good businesses (major key), go ahead and trim those “expensive” names and add to those “cheap” names if that suits you. Not only will your results be just fine, but you will have much lower stress and make clearer decisions.

Have fun out there!