I outlined a major framework of my investing in a previous post: Microsoft versus IBM

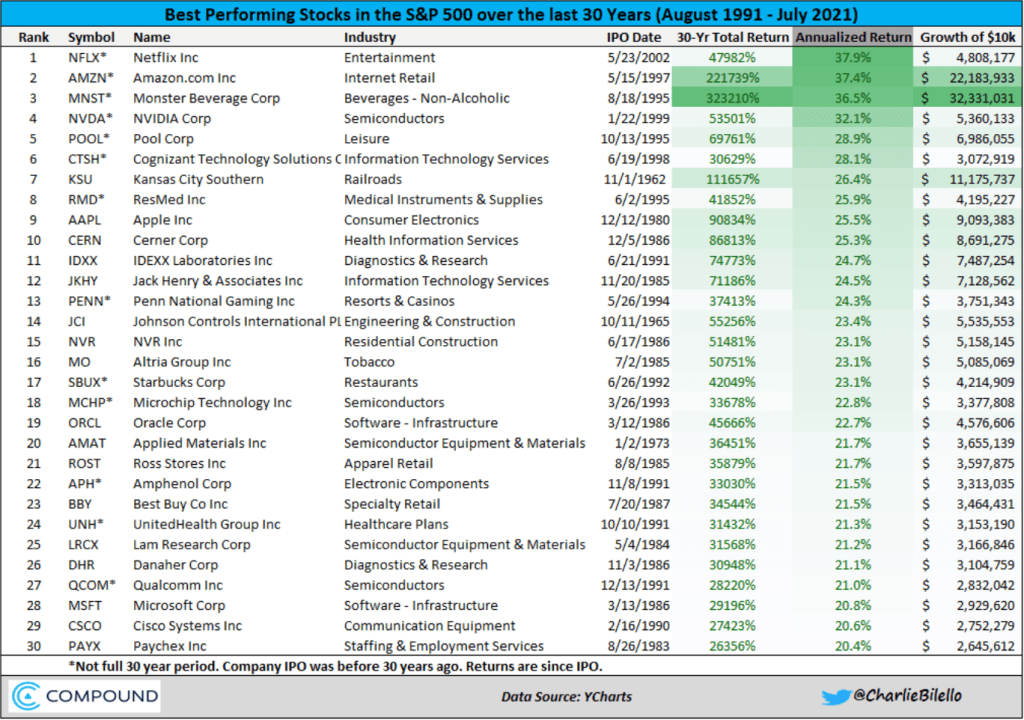

This of course got me thinking that I should do a regulars series on “following fundamentals”. So this is the start. To make things easy, I am stealing a list of the best performing 30 stocks from the last 30 years:

The question is straightforward:

Based on what I have deemed to be important in business ownership, how many of these stocks would I have identified along the way as good investments?

This is not to say I would have invested in them or even so, held for a long period, but would I have even given myself a chance?

As a refresher, here is what I deem to be important:

- Profitable – Absolute (Positive Cash Flow), Efficiency (i.e. ROIC), Margins

- Healthy – Manageable Debt, Fundamental Volatility, Negative Accruals, Self-Funding

- Growing – Positive Top-Line & Operating over last few years

- Yield – Returning cash profits to shareholders?

- Valuation – Reasonable? Chance for expansion or limited contraction?

I don’t have too many industries I avoid outside of banks/commodities, so the universe is vast.

Apple Inc – $AAPL

I chose Apple first for two reasons. One, its technically in alphabetical order by symbol (Not sure what the order will be), but more importantly, it’s a stock I’ve never owned. Should be fun to torture myself on the first stock =)

Here are the previous 20 years of financial data for Apple. Since this is about “fundamentals” I will be referring back to this picture quite a bit:

Unlike some other companies I may look at, Apple had a very pivotal moment in the last 20 years. The iPhone. This happened in Summer 2007. Because of that, we should keep an eye out on 2007 and see if fundamentals changed noticeably.

Apple Fundamentals

The Profitability history outlines the 2007 year quite substantially. Whether it is via ROCE or Margins, we can see a large jump in 2007-2012. ROCE went from 9.2% to 38% and Free-Cash Flow margins went from 8.3% to 25.7%. Massive moves.

The health of the company has been strong for two decades. Minimal to zero debt. No issues with accruals. Margin volatility was a bit jumpy but really went off the cliff (In a good way) in 2013. There we’re some self-funding issues for many years (Hence the equity issuance) but this is not uncommon for companies releasing new products.

In terms of growth, there were some blips in the early 2000s, but since about 2004/2005, the growth has been consistent and positive (Excluding one fiscal year in 2019). Free-Cash Flow went from negative $47 Million in 2001 to $73 Billion in 2020. Not bad.

When a company can’t self fund, they can either issue debt or equity. Apple chose the later. As we can see, their shareholder yield was negative for most of the period. This of course means that shareholders were being diluted a little bit every year. Once the iPhone became a stable product, we started to see that course reverse in 2013 and since then Apple has been one of the most consistent companies in terms of returning cash to shareholders.

Last is valuation. Unlike most “tech”, Apple was actually “cheap” in 2001-2003, and then became relatively “expensive” from 2004-2010. Now here is the interesting part. Despite the iPhone taking off and the company really starting to look good, valuation started to stall in 2011/2012. By 2013 it was trading at a 35% discount to the market.

Conclusion

Clearly there were many questions about the future of the iPhone in 2013 or why would a company that looks that pristine fundamentally be that cheap? The company had higher profitability than the market, was financially healthier, was growing faster, but was cheaper?

This is the exact scenario that has led me to my theory on following the fundamentals, not the headlines. I’m not saying it is easy to do. Nor am I saying it works all the time. I know I’m starting this series with the best performing stocks over the last 30 years. At some point I will test out poor performing stocks (All ears on suggestions).

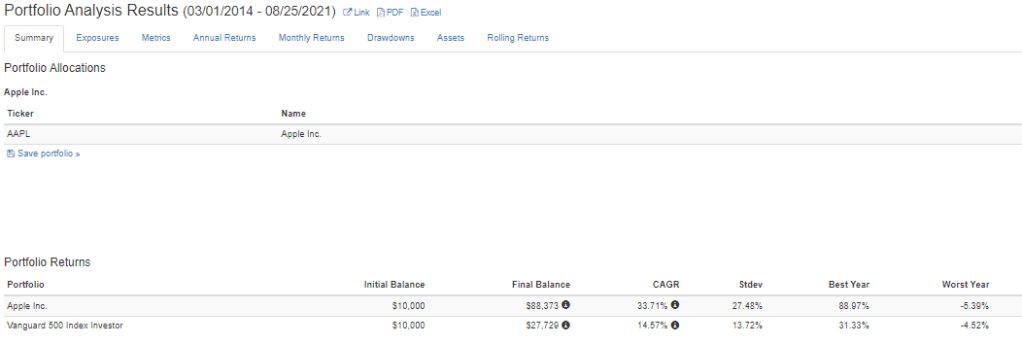

I highlighted 2013-2019 as years where I would have considered investment from a fundamental perspective. It checks every box in those years. Lo and behold, if you invested in March 2014 (After 2013 FY 10-K released in Feb), your returns on the position would have looked like this:

Again, who knows what questions I would have asked myself about Apple in 2014, but by focusing on fundamentals, I would have at least given myself a chance at owning it. Not unexpected, but score one for the “follow the fundamentals” theory.

Feedback and suggestions for future companies to look at are always welcome.

Have fun out there!